Originally Published On: March 17, 2022

The Payroll team often receives questions regarding income tax. Please see the frequently asked questions below with answers provided by the Payroll team. We also encourage you to speak with a tax professional to address questions to your specific tax situation.

Please note: the below Q&As address the income tax Christian Horizons deducts at the source. The objective is to follow Canada Revenue Agency (CRA) guidelines and maximize employees’ take-home pay while also minimizing any potential tax liability when income taxes are filed. At the end of every year when you file your tax return, all earnings (e.g., regular pay, overtime, stipends, retros, payouts) for the year are combined and taxes owing are calculated according to the tax brackets for that year.

Click here to view this article on CHconnect.

Click here to download the printable PDF of this article.

Why does Christian Horizons deduct income tax?

Christian Horizons is required as a Canadian employer to deduct income tax at source, from employees’ pay, and remit it to the government on your behalf.

How do the tax rates work?

In Canada, taxes are calculated on a graduated basis, which means your rate of tax increases the more you earn. Under this system, income is divided into brackets which determines the applicable tax rate.

What are tax brackets?

Tax brackets are created by the CRA to determine how much money you need to pay in personal income tax every year. A tax bracket is the tax rate applicable to the different ranges of income. The amount you are taxed depends on your income.

How do I determine which tax bracket I am in?

Everyone starts each calendar year in the same tax bracket. Once your income goes beyond the first tax bracket, then the portion of income that falls within the next tax bracket is taxed at the higher rate and so on.

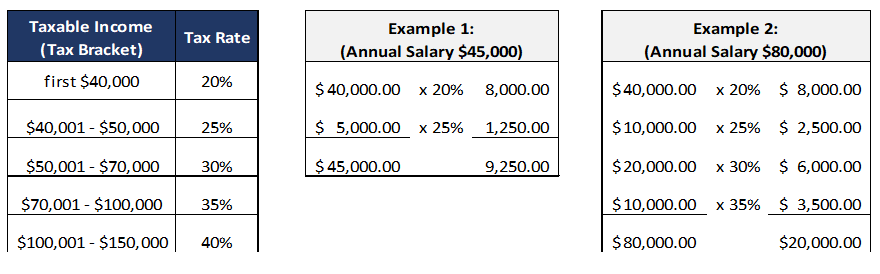

Example: (Please note the tax brackets below were created for this example only and do not represent actual current CRA tax brackets)

How does Christian Horizons determine how much income tax to deduct from my regular pay?

Christian Horizons pays employees on a bi-weekly basis, so regular earnings for the current pay are multiplied by 26 pay periods to estimate the annual earnings and then taxed in accordance with the CRA regulations.

What about when I have a stipend, retro, or payout, does that increase the tax rate on my regular pay?

No. Per CRA regulations, tax deductions for stipends, retros, payouts, are calculated using the bonus tax method which is different from the regular income tax earnings method.

What is the bonus tax method?

The bonus tax method considers one-time or irregular payments, such as a bonus, separately for the purposes of calculating income taxes by spreading the one-time payment out over the entire payroll year to determine tax rate.

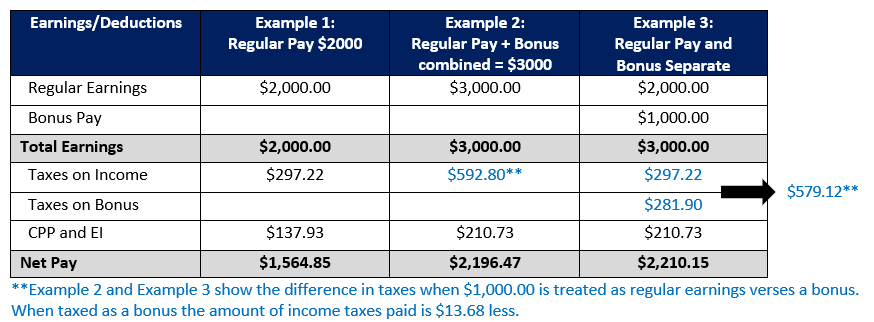

The examples below reflect the difference between regular income tax earnings method and bonus tax method and are for illustration purposes only. (Calculations were completed using the Payroll Deductions Online Calculator available through the CRA website)

If Payroll paid stipends, retros, or payouts, on a separate cheque, would it reduce my tax deduction implications?

No. Creating a second payment in the same pay period will not change the impact. Christian Horizons calculates pay based on a bi-weekly pay cycle and therefore all earnings within the pay period must be considered when calculating deductions for the pay period. Therefore, splitting the pay does not reduce the taxes.

I have more than one employer or other sources of taxable income, what should I do?

If you have more than one employer, you should complete a TD1 form each year. You are eligible for a personal tax credit on your first portion of earnings, but this tax credit can only be claimed once. If you have more than one employer, only one employer can include this credit when calculating your tax deductions. If both employers claim the same tax credits, you might end up owing tax at the end of the year. You also may want to work with a tax professional to determine if you want to have additional tax taken off each pay to avoid having a balance owing when you file your personal return because the total sources of taxable income may put you in the next tax bracket (see tax bracket question above)

Are there other tax credits I may be eligible for on my TD1?

Yes. Other examples of tax credits are:

- You have children living with you under the age of 18 (only one parent can claim this credit)

- You are over 65 years of age

- You are a student enrolled in university or college

- You are eligible to claim the disability tax credit

- You are supporting a spouse whose net income is less that the basic personal amount

What is Box 40 on my T4?

Box 40 on your T4 includes any taxable benefits for full-time employees received during the year. This may include:

- Dependent life insurance benefit – as part of Christian Horizons’ benefit package, we pay for life insurance for dependents. The cost of these premiums is added to your taxable income so that if you ever received a life insurance payout, the lump sum would not be taxable.

- Christian Horizons Paid Registered Retirement Savings Plan (RRSP) Benefits – This is the portion that Christian Horizons contributed to your RRSP during the year if you are enrolled in the RRSP group benefit plan. You should receive RRSP contribution receipts directly from Canada Life for RRSP contributions for both the employer paid and personal contributions that will offset this taxable benefit.