Originally Published February 16, 2023

Canada Housing Benefit

The Government of Canada currently has a one-time top-up program to the Canada Housing Benefit in place to assist people who have low incomes with the cost of housing. Applications for the Canada Housing Benefit must be submitted by Friday, March 31, 2023, in advance of the tax filing timeline.

To be eligible for the one-time tax-free payment of $500:

- A person’s income needs to be $20,000 or less, or $35,000 or less for a family, and

- The amount of rent paid in 2022 is equal to 30% or more of a person’s 2021 income.

The Canada Revenue Agency (CRA) will verify that the 2021 income is below the limit, based on the filed 2021 income tax return when an application for the benefit is submitted. Line 23600 of a person’s income tax return is the basis for the income amount.

The CRA has confirmed that this program is applicable for those who reside in Christian Horizons Group Living, Supported Independent Living and similar programs and pay either the client contribution, maintenance or rent. We expect that the majority of people receiving these types of services from Christian Horizons would be eligible for this $500 one-time benefit.

To apply for the Canada Housing Benefit, a person must have already filed their 2021 income tax return and will need the following information:

- Amount of client contribution, maintenance fee or rent paid to Christian Horizons in 2022:

- Where people pay a client contribution or maintenance fee to Christian Horizons, that amount includes more than the cost of housing, and, as a result, only 90% of the amount paid for 2022 is eligible to be claimed as the rent amount.

- For people living in programs that have a lease agreement specifically for housing, 100% of the amount paid under that agreement would be considered eligible rent for the program.

- Landlord name and telephone number (Christian Horizons, 519-783-6810).

- Address of their home and the number of months living at that home. All addresses need to be reported if the person lived at multiple addresses during 2022.

- Date of Birth and Social Insurance Number.

Applications can be made using the CRA My Account, an online application form, or by telephone. Each method has a different processing time, between 5-12 days. It is not necessary to have a CRA My Account set up to submit an application and the online application form may be used where CRA My Account access is not in place. Application options are available through the following link: How to apply – One-time top-up to the Canada Housing Benefit – Canada.ca.

Where people are unable to complete a submission on their own, the following should assist with submitting a claim and attesting:

- A family member, substitute decision-maker or advocate;

- The Public Guardian and Trustee, where people receive financial support from the PGT; or

- Staff support to verify and attest to information on a person’s behalf if the first two options are not in place.

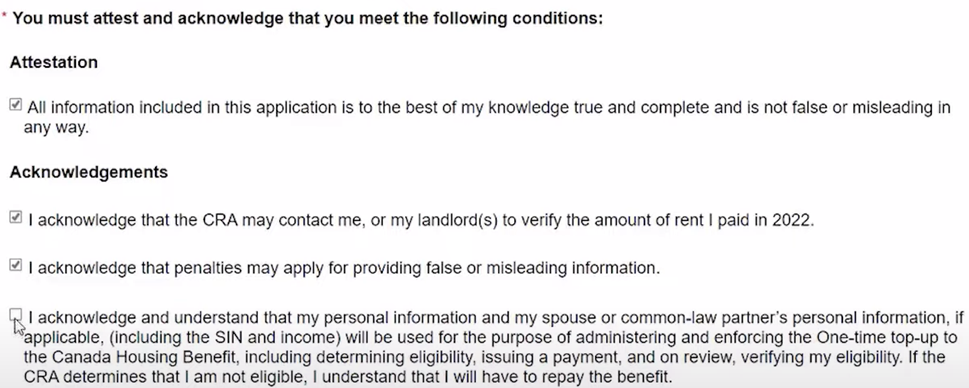

The attestation that is required to submit a claim is as follows:

A submission confirmation will be provided once the claim is submitted, and it is recommended that this confirmation is retained to verify the submission. Once funds are received, however, the submission confirmation is no longer necessary.

Note that there is no impact on income taxes or other benefit programs, as the Canada Housing Benefit top-up payment is non-taxable.

Maintenance receipts may be obtained from the Accounting Specialist for your area, as follows:

Central / North: Barbara Bender – bbender@christian-horizons.org

South / West / Saskatchewan: Tricia Vanderloo – tvanderloo@christian-horizons.org

Central East / East: Emnet Thackeray – ethackeray@christian-horizons.org

Other information sources:

- CRA video on submitting a claim: Canada Housing Benefit – walkthrough – YouTube

- Full program information: Canada Housing Benefit – Canada.ca

Resources for Filing Personal Tax Returns

It is also approaching the time of year when personal income tax returns need to be prepared and filed. The deadline for most individuals to file their 2022 tax return and for all individuals to pay any amounts due is May 1, 2023, since April 30th falls on a Sunday this year. We have, once again, compiled links to free tax clinics and resources for assistance in filing personal income tax returns of people receiving support on the following page.

An appointment is generally required to attend one of the free tax clinics. However, there are options for walk-in, drop-off, and virtual clinics as well. Details of the appropriate contact person or group are found in the website links provided on the next page. These free tax clinics fill up quite quickly, so do not hesitate to contact them as soon as possible.

Christian Horizons does not provide training or assistance to prepare personal tax returns for people receiving support. Although these tax returns are often quite straightforward, the Income Tax act and related tax legislation can be complex. Tax rules are constantly changing and evolving and each year there are new tax amendments introduced. Please seek assistance from the tax clinics or another professional to support someone in preparing a personal income tax return.

A. Canada Revenue Agency – Community Volunteer Income Tax Program (CVITP)

The Canada Revenue Agency (CRA) is again offering the CVITP. This is a free service to assist eligible individuals who need help to complete their income tax returns. The tax clinics are hosted by community organizations across Canada where tax returns are done for free by volunteers.

To qualify for assistance under the CVITP, individuals must have a modest income and a simple tax situation. Eligibility requirements include income levels under $35,000. These clinics deal with simple personal tax returns, which excludes returns for individuals who are self-employed or who have employment expenses and returns for deceased individuals.

For details on whether a clinic will be able to assist and for booking an appointment, please contact the location nearest you. The following website link has further details on the tax clinics and also has a searchable list of CVITP locations if you click “Find a tax clinic in your area” at the bottom of the web page: Free tax clinics – Canada.ca

If you cannot find a tax preparation clinic in your area, check back again as community organizations may add clinics during the filing period. Most clinics are offered in March and April.

B. Canada Revenue Agency – Learning about taxes

The CRA offers an online, independent, self-paced learning unit which introduces Canada’s tax system and teaches how to prepare a basic income tax return. This is provided for information purposes – as mentioned, please seek assistance from the tax clinics or another tax professional to support someone in preparing a personal income tax return.

- To access the CRA online tax training program, please visit: https://www.canada.ca/en/revenue-agency/services/tax/individuals/educational-programs.html

- Information on tax measures for persons with disabilities from the CRA is available from the following link: https://www.canada.ca/en/revenue-agency/services/tax/individuals/segments/tax-credits-deductions-persons-disabilities.html

If you have any questions, please contact Stewart Davidson at sdavidson@christian-horizons.org.